July 2025 U.S. Housing Market Report

Where Sellers Must Reflect and Buyers Can Afford to Be Choosy

Prepared by Joe Ballarino, Team Lead – Amerivest Pro-Team powered by Real

Key Takeaways

- Home sales dipped again, with NAR reporting existing-home sales at a nine-month low in June.

- Inventory is rising, and homes are sitting longer on market, putting pressure on sellers to price wisely or step aside.

- Prices remain near all-time highs, but the growth is slowing—especially in the South and West.

- Buyers hold more leverage now than at any point in the last 18 months.

- Sellers must assess motivation: Is now the right time to list, or should you wait?

- Buyers can afford to be picky, especially with inventory growing and price reductions becoming more common.

Sales Volume Drops as Buyers Pull Back

National home sales took another step down, with the National Association of Realtors® reporting a 2.7% decline in existing-home sales in June 2025 compared to May—landing at a seasonally adjusted annual rate of just 3.93 million homes sold. That’s the lowest monthly pace in nine months and reflects a flat year-over-year trajectory.

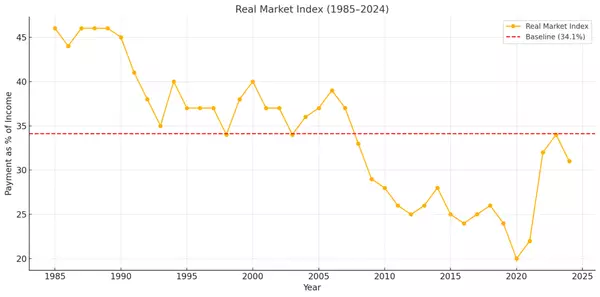

Behind the dip is a combination of high home prices, still-elevated mortgage rates, and buyer fatigue. Many prospective buyers are waiting for more favorable terms or a broader selection of homes. NAR Chief Economist Lawrence Yun noted that “limited inventory continues to hinder transactions,” but the demand curve is also flattening as affordability tightens.

Pending home sales—a forward-looking indicator—also fell 0.8% in June, with the steepest year-over-year decline (2.9%) showing up in the South. This suggests that July and August closings could remain soft.

New Construction Holding Market Share… But With Caution Signs

New home sales offered a bit of balance. The U.S. Census Bureau reported that new home sales ticked up 0.6% month-over-month to 627,000 units (seasonally adjusted) in June. However, that still represents a 6.6% drop from June 2024—revealing the fragility even in the new home market.

Interestingly, the median new home price dropped nearly 5% from May to $401,800—making it cheaper than the existing-home median for the first time in years. Builders are adjusting to buyer pushback, often offering rate buydowns or incentives to close deals.

Inventory of new homes continues to climb, now sitting at a 9.8-month supply, according to HUD data. That’s an 8.5% increase from last year and signals that builders are being more cautious heading into late summer.

Prices Near Record Highs—But Momentum Is Slowing

The median sale price of existing homes reached an all-time high of $435,300 in June, according to NAR. But the growth rate is decelerating. The S&P CoreLogic Case-Shiller Index, which tracks actual closing prices in 20 metro areas, rose just 2.3% year-over-year in May—the slowest pace since mid-2023.

Certain cities, like Detroit (up 23.5% year-over-year) and Rochester, NY (up 22.7%), are still experiencing rapid price gains. But nationally, more homes are seeing price reductions. Realtor.com reported that 20% of active listings had cut prices in June, and Redfin data shows over 21% of homes saw price drops in the same period.

In a rare twist, Realtor.com also revealed that the median list price now exceeds the median sold price in many metros—suggesting that aspirational pricing is giving way to market realities.

Regional Trends: Inventory Gains, Seller Hesitation

Total inventory (active listings) jumped nearly 29% year-over-year in June, per Realtor.com’s Housing Trends Report. Buyers now have more to choose from—but many of those homes are lingering.

The median days on market rose to 53 nationally, five days longer than June 2024. In mid-sized and Southern markets, the increase is even more pronounced. Redfin reports that homes in some cities are staying active for 40 to 60 days, compared to barely 20 days in 2022.

Many sellers are responding not by adjusting price, but by withdrawing listings entirely. Business Insider reports that delistings are up 35% to 47% year-over-year in key metros across the West and Southeast. This trend hints at a stand-off: sellers hoping for yesterday’s prices versus buyers who now have options and patience.

My Take: Motivation Matters More Than Ever

This evolving market prompts a difficult but necessary question for today’s sellers: Why are you selling?

If the answer is “I must sell,” then it’s critical to set reasonable expectations on both timing and price. Homes that are well-priced and well-presented are still moving—but overpricing in today’s climate is a sure path to disappointment or withdrawal.

If the motivation is simply to “test the market,” sellers should brace for longer wait times or prepare to walk away. And if the goal is to get top dollar, this may not be the ideal moment to list at all—especially if there’s no urgency to move.

Conversely, buyers are in a better position than they’ve been in quite a while. More inventory, longer days on market, and an increase in price cuts create breathing room. It’s wise to stay selective and disciplined right now. While prices haven’t fallen dramatically, they’ve stopped rising at the breakneck speed of recent years—and in many markets, that puts power back in the hands of the buyer.

Closing Thoughts

We're not in a full-blown buyer’s market yet—but the landscape is clearly shifting. Pricing power is no longer tilted fully toward sellers. And in many metros, buyers can afford to take their time, negotiate repairs, or pass on homes that don’t check all the boxes.

As a real estate team lead, I believe the months ahead require clarity of motivation—both for those considering listing and those actively house-hunting. Success in today’s market isn’t about gaming the system. It’s about strategy, timing, and clear intent.

— Joe Ballarino, Team Lead

Amerivest Pro-Team powered by Real

Recent Posts