The Hidden Mortgage Fee Costing You Money Every Month

by Amerivest Pro-Team

🔍 TL;DR – Key Takeaways:

- Private Mortgage Insurance (PMI) is a fee added to your mortgage if your down payment was less than 20%.

- PMI protects the lender, not you, and can cost $50–$200+ monthly.

- You can request PMI removal once your loan-to-value ratio reaches 80%.

- Removing PMI can save you thousands over the life of your loan.

- Learn more about the role of real estate brokers in our latest insight.

What Is PMI? (And Why Are You Paying It?)

Private Mortgage Insurance (PMI) is a monthly fee added to your mortgage payment if you didn't put down at least 20% when purchasing your home. It protects your lender—not you—in case you default on your loan. The cost can range from $50 to over $200 per month, depending on your loan size, potentially adding up to thousands annually.

How Do You Know If You Still Have PMI?

Consider the following:

- You bought your home with less than 20% down.

- You didn't use a VA loan.

- You haven't reached 22% equity yet (some lenders auto-cancel PMI at this point).

If these apply to you, it's time to check your mortgage statement or contact your lender.

How Can You Get Rid of PMI?

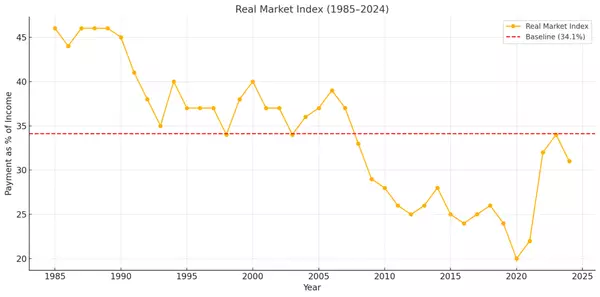

You can request PMI removal when your loan-to-value (LTV) ratio hits 80%. This can occur through:

- Regular mortgage payments reducing your principal.

- Making extra payments toward your principal.

- Appreciation increasing your home's value.

Steps to remove PMI:

- Contact your mortgage lender.

- Inquire about their PMI removal process.

- They may require a new appraisal.

- Submit a formal request if eligible.

Note: Some lenders automatically cancel PMI once you reach 78% LTV, but it's beneficial to act sooner if you qualify.

Still Paying PMI? You Might Be Wasting Money

Paying $150/month in PMI equates to $1,800 annually—funds that could be directed toward savings, home improvements, or accelerating your mortgage payoff. If you've owned your home for a few years, rising property values may have increased your equity, making you eligible to remove PMI.

Bottom Line

PMI was essential in helping you purchase your home, but it doesn't have to be a permanent expense. Review your equity, consult your lender, and eliminate unnecessary fees to reduce your monthly mortgage payment.

👉 Want to understand the broker’s role in more detail? Read our newest insight: Who Is a Real Estate Broker—And Why It Matters.

Recent Posts