7 Tips for Buying a House: We'll Help You Find Your New Home

A home is often the single most valuable asset an individual or family owns.

That fact alone means a thoughtful approach and careful planning are crucial when you enter the real estate market as a home buyer. Your credit score, the type of home loan you seek out, your financial ability to make a payment each and every month, and similarly foundational elements deserve some in-depth attention.

When you start considering the amount of time you and your family will spend in your new home, how its location will impact the schools your children attend, the length of daily commutes to work, and many other factors, it quickly becomes clear that you need to take a detail-oriented approach to buying a house.

Amerivest Realty is here to help you do exactly that. Keep reading to discover helpful and practical tips for buying a house. Along the way, you’ll learn how our Realtors® across Colorado and Florida can offer valuable support throughout the process.

Get Ready to Secure a Mortgage and Buy a New Home

There’s plenty of work you can complete before you ever set your eyes on a specific home and submit an offer.

Ideally, you’ll work through the mortgage pre-approval process, which we’ll detail below, before you narrow down your prospects or select the home you most want to purchase. Similarly, you should build a strong understanding of your current financial position, and limit or stop certain activities that could impact your credit score or raise red flags for lenders, well before you make a decision to buy a home (two more topics we’ll dive into later on).

The time you invest will pay off: You’ll be ready to confidently and capably move ahead in the home buying process, regardless of the current state of the housing market. And that could mean the difference between an accepted offer and a longer process with more bids, uncertainty, and time taken until you can finally make your move.

1 - The Importance of Pre-Approval as a Buyer

In the context of purchasing a new home, pre-approval refers to the process a lender completes to determine the maximum amount a client can borrow for a home loan. This is incredibly valuable because:

- Pre-approval establishes a price range in your search for a new home. By taking the maximum amount approved into account, you can focus on homes with an asking price that fit into the loan’s limits. You can focus more on finding the home that’s right for you.

- The lender provides a pre-approval letter, which clearly demonstrates your ability to (at least conditionally) secure a mortgage loan. Sellers often ask for a pre-approval letter before they move forward on an offer. Having a pre-approval letter that’s ready to share demonstrates that you’re not only serious about the process, but organized and engaged as well.

- You can learn about the different options available for a loan, and how they might benefit you, through a detailed discussion with your lender.

- You can uncover potential issues related to your credit and, ideally, address them.

It’s important to note that, despite its name, pre-approval does not offer a complete and total guarantee that you will receive a home loan when you submit your application.

While it’s a strong indicator that you have the financial means to secure a loan, there are still some circumstances that could lead to a denial. You might have a major change related to your assets, income, and debts between pre-approval and final approval that causes your lender to reconsider eligibility.

Outside of your own finances, if the appraised value of the home is significantly lower than the sale price, your lender likely won’t want to take on that kind of risk and may not approve the loan. In this and similar situations where an issue exists with the home, such as a problem with disputed ownership or a lien on the title, you can still use your pre-approval to your advantage if you start the buying process over with a different home.

One last detail around pre-approval to keep in mind: It doesn’t last forever. Most pre-approval letters are only good for 60-90 days, depending on the specific rules set by your lender.

You can renew your pre-approval, and the process is relatively simple as most of the needed information is already in the hands of your lender. However, the pre-approval process requires a hard inquiry into your credit file. The impact is limited, but it can lower your score to an extent. When you seek out pre-approval, your best bet is to be ready to start the buying process if and when you receive your letter from your lender.

2 - Have Your Down Payment Ready

The down payment is critical to most home purchases. While certain mortgage options eliminate the need for down payments, such as a USDA or VA loan, they’re not available to everyone or applicable to every real estate transaction.

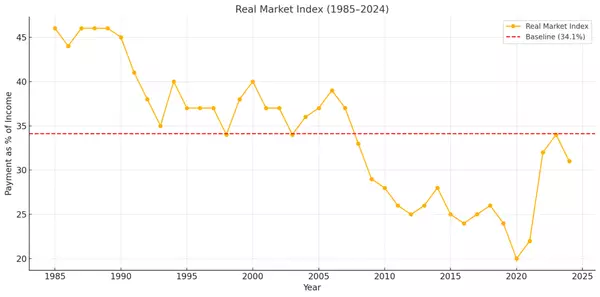

Ideally, you should have 20% of your new home’s total price saved to use as a down payment. Having this substantial amount of money set aside boosts your chances of approval on a mortgage application, and can help you access more attractive terms and conditions, like a lower interest rate. In the long run, paying more upfront means lower costs over the life of the loan.

Many lenders are willing to work with a home buyer who has saved in the range of 10-15% for their down payment. This can be an effective option if you have sizable savings ready to put toward a home purchase, but can’t realistically bring together the ideal 20% of the total cost before moving forward.

This approach can lead to additional costs, like a higher interest rate or the need for mortgage insurance, to the table. Those changes may have a long-lasting impact on your finances, with many years of higher payments to consider. However, moving forward with a home purchase can still be the right decision.

On a purely financial level, higher costs can still be worth it if your home appreciates in value and offers a positive return in the future. And, while costs are especially important, home ownership is more than a decision based only on money. A space for yourself and your family that you control can offer unique and powerful benefits related to your quality of life.

If you can’t put a full 20% down payment on the table, be aware of the increased financial commitment, but take the other valuable aspects of home ownership into account when deciding whether or not to move forward. Need assistance? Try our Mortgage Calculator to set the terms of your loan and applicable payments for a clearer picture.

3 - What NOT To Do Before Buying a House

A lender generally wants to see a high level of reliability from an individual or couple applying for a mortgage. Recent life changes that negatively affect your credit score and report as well as your debt-to-income ratio, or that more generally indicate a lack of stability, can lead to a denial of your application.

Avoid the following actions until your application is approved and you officially own your new home:

- Making a major purchase, like a boat or car.

- Canceling or opening new credit cards.

- Paying your bills late or skipping a payment, especially for an existing mortgage.

- Changing your job.

- Depositing large sums into your banking accounts.

- Doing anything that leads to a hard credit inquiry or could significantly change your credit score.

A home is one of the most important assets the average person can own, in terms of both its value and its function. While it can certainly be inconvenient to take on these activities during the home buying process, finding a new house on a shorter timeline and with fewer complications will likely be worth it.

Finding a Great Real Estate Agent

Your real estate agent should be a committed professional with deep knowledge of this industry in general and your local market in particular. How can you find the best real estate agent possible to support your goals and make the process as smooth as it can be?

4 - Choose a Realtor® as Your Agent

One foundational piece of advice: Working with a Realtor® means having a reliable real estate professional who is not only licensed, but held to a high ethical standard through their membership in the National Association of Realtors® (NAR).

Real estate agents go above and beyond the basic standards of the profession when they commit to becoming a Realtor®. The NAR Code of Ethics states: “Realtors® pledge themselves to protect and promote the interests of their client. This obligation to the client is primary, but it does not relieve Realtors® of their obligation to treat all parties honestly.”

When you work with a Realtor®, you can count on the assistance and support of a professional who is directly obligated to put your best interests first. You also don’t have to worry that an agent’s desire to prioritize your needs could negatively impact the other parties involved, because the NAR Code of Ethics requires fair dealing with all stakeholders.

The ability to place full trust in your Realtor® is incredibly valuable, but not the only benefit these professionals bring to the table. NAR members also have access to market data and services that assist in managing transactions, Realtor.com explained. Ready to find your Realtor®? Search our agents by name to get started!

5 - Ask Plenty of Questions

While all Realtors® have the skills and knowledge needed to capably handle a residential real estate transaction, these professionals can have differing areas of expertise and past work to draw insight and guidance from. Every agent’s background is different, so choosing the one who can best support your needs is crucial for a straightforward and successful process.

If you have specific needs related to a home — perhaps you’re focused only on the high-end luxury market, for example — ask potential agents about their experiences working with clients who purchased a similar type of house.

You can ask more general questions, too. Has your Realtor® successfully supported buyers in a seller’s market in the past? Do they know any qualified home inspectors? Are they working with fellow Realtors® to bring you new information about a home that aligns with your needs?

With a few questions, you can ensure your Realtor® offers the best combination of skills and experience to support your needs.

Act Carefully Before Closing: Inspections and More

Once you have an offer accepted, you’re close to the finish line. There are still some key needs to address, however, before you can close on the home.

6 - Make Sure You Have a Home Inspection

A home inspection is crucial for assessing any current problems or potential future concerns within residential real estate. Your mortgage lender will have a home appraised before finalizing the necessary documents. But that activity, which focuses on determining the home’s value and limiting risk on the part of the loan provider, is not equivalent to a home inspection.

The payment you make to a qualified home inspector is always worthwhile, as they can discover issues that:

- May make the house no longer worthwhile in your eyes, allowing you to avoid purchasing a property with serious issues.

- Point out more minor problems that can easily be addressed in the present, but could otherwise go unnoticed and cause more serious damage as time passes.

- Give you leverage in the negotiation process. You may be able to save money on closing costs or the sale price of the home by raising an issue discovered by a home inspector.

You should recognize that home inspections don’t address every single potential issue that could exist in a house. Inspectors are limited to finding what is visible to them as they carry out their duties.

They won’t knock a hole in a wall to check for water damage or mold, for example, nor look inside the service lines that connect a home to its water supply (although they do inspect for visible leaks and cracks). Don’t take a successful inspection as a guarantee that there are absolutely no issues already present, or that could arise after purchase.

Still, home inspections cover an awful lot of ground. In the hours that a professional spends moving throughout a home and checking for defects and faults, they cover everything from air flow and the safety and usability of electrical sockets to the condition of the roof and compliance of wiring with relevant safety codes. You can learn a lot from the report your inspector generates and any issues they choose to bring up directly.

7 - Be Prepared for Closing Day

Closing day is a major event — the home you’ve put so much money, time, and effort into owning will officially become yours! Here are a few pieces of advice to make closing as successful as possible:

Bring Everything You Need

The good news on closing day is that you aren’t responsible for bringing that much to the table. As long as you can prove your identity and offer payment, you’re usually good to go (we’ll look at some exceptions below). But what happens if you forget your driver’s license, or your checkbook is on the kitchen counter instead of in your pocket?

You probably won’t miss out on the opportunity to finalize the purchase of your new home, but you’ll have to make everyone wait while you sort out the issue. The last thing you want to do is throw a wrench into the process when it’s so close to completion.

To that end, make sure you have a government-issued photo ID and your form of payment with you before you start your trip to the designated location. This is a situation where double-checking is worth it, even if you’re already sure you’re ready to go. And if you’re buying the house in both your and your partner’s names, be sure they have their ID, too.

Make the Meeting Your Top Priority for the Day

Closing day represents what is likely one of the single largest financial transactions in your lifetime. With that in mind, it might be surprising to hear that the process can be over in less than an hour. However, there’s always the potential for a complication to arise, like a delay in processing the necessary documents.

While you don’t need to take the entire day off from work, you should block off at least a few hours for the appointment and build in the estimated length of the trip to and from the office as well. You might want to give yourself some time to celebrate your home purchase, too. Once the paperwork is done, closing can be an opportunity for some festivities.

Budget a generous amount of time when traveling to the meeting as well as for the meeting itself — you might not need it, but it’s far better to avoid any tight scheduling during such an important day.

Keep in Contact With Your Realtor®

Your Realtor® is just as eager as you are to close the deal and make things official. They can offer you support and guidance on closing day, just like they did throughout the entire home buying process.

A check-in the morning of your appointment can be a good way to make sure you bring everything for which you’re responsible. While most closings only require the buyer to prove their identity and pay, certain circumstances might necessitate some additional documentation. Proof of homeowner’s insurance is just one example. It’s not always needed, but often is. There are other situations where you might need to bring more information or documents, so make sure you communicate with your agent ahead of time to make sure all responsibilities are addressed and you have everything you need before arriving.

Finding Your Next Home With Amerivest Realty

Amerivest Realty is here to support your search for your next home.

We’re committed to providing high-quality and consistent support for each and every one of our clients. That starts with sharing useful guidance for everyone considering a new home purchase and doesn’t end until the closing process is finalized and you have the deed, keys, and everything else you need in hand.

Our property listings page offers many options to narrow down your options to only the most relevant ones, and our Independent Realtor® Associates can provide expert assistance and support. Browse our site to begin your search or contact our team to get started!

Recent Posts